Contact Person: Summer

Tel:+86 18832925915

E-mail: [email protected]

skype:+86 18832925915

WhatsApp: +86 18832925915

Add:Yang Er Zhuang Industy Qing He County Xing Tai City He Bei Province China

Diesel Engine Filters Aftermarket in Mexico

The Mexican auto parts production was worth US$85,000 million1 in 2015, 6% higher than in 2014, not only making Mexico the sixth largest global manufacturer after China, Japan, the United States, Germany, and South Korea, but also the leader in Latin America.

The Mexican auto parts production was worth US$85,000 million1 in 2015, 6% higher than in 2014, not only making Mexico the sixth largest global manufacturer after China, Japan, the United States, Germany, and South Korea, but also the leader in Latin America.

Given Mexico's strategic geographic position, open economy (Mexico is among the countries that have the most free trade agreements signed in the world), as well as its low cost, skilled, and qualified labor force, the country is a natural hotspot for auto parts manufacturers' investments.

Many tier I and II companies are moving their facilities or opening new plants in Mexico following original equipment manufacturers' (OEM's) greenfield and expansion plans in the country.

Such is the case with Nissan, Mazda, GM, VW, and Toyota, among others.

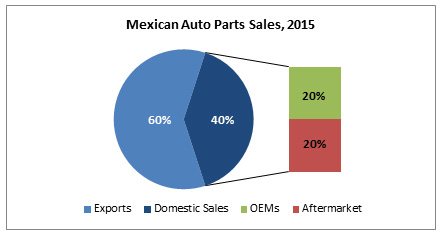

Although almost 60% of the Mexican auto parts are exported, mainly to the United States, growth of the domestic automotive market, increasing sales and investments in civil construction and mining projects, and the expanding oil & gas industry are expected to increase the national vehicle fleet and hence, the domestic demand for auto parts. Of the remaining 40% of domestically manufactured auto parts, 20% are sourced to OEMs and the other 20% to the aftermarket segment. Frost & Sullivan estimates that filters for diesel engines for transportation, mining, and construction vehicles could represent between 1.4% and 1.6%.

There are more than 15 active market participants that compete on the diesel filters aftermarket. The most important ones are Fleetguard, Donaldson, Baldwin, and WIX, with growing participation of local brand Gonher that has been experiencing growth in market participation during the last 5 years. OEM brands have shown growing market penetration over the past few years, mainly Caterpillar, pushed by Owner Manuals' recommendation and also due to extended warranties given by OEMs that oblige customers to use OEMs' parts and accessories during the first 5-year period, creating a captive market. Although OEM filters are growing, on many occasions filters labeled under OEM brands are manufactured by top market manufacturers.

The Mexican filters aftermarket for diesel engines (transportation, mining, and construction) was worth about US$234 million and about 13 million units in 2015, and is expected to experience a compound annual growth rate (CAGR) of 5% until 2019 according to Frost & Sullivan estimates.

The country currently faces a huge challenge with regard to counterfeit auto parts, mainly imported from Asia, and many times labeled under big multinational companies with dominant market participation. This issue not only impacts engine operation but also hurts the brand name. To fight this challenge, the Mexican Association of Filters Manufacturers (AMFFI), involving the most important market participants, is developing consciousness campaigns to alert customers of the risks of using "clones" or illegal parts. These illegal parts can cost up to 60% less than the original ones.

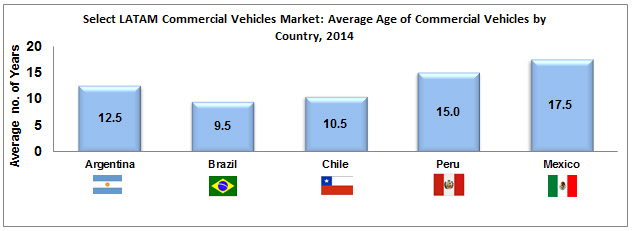

Another major challenge the filter market faces is an aging commercial vehicle (CV) fleet parc. The Mexican medium and heavy duty truck fleet (Class 5 to 8) is one of the oldest in the region, about 17.5 years old on an average. This poses a big challenge for the aftermarket because, although more services are needed for these units, owner operators (1 to 5 trucks) and small fleet owners (6 to 10) that represent almost 90% of the total fleet tend to buy low cost or Asian parts for their vehicles. The main driver for Mexican ageing CV fleet is the legal and illegal imports of used US trucks ("Chocolate Trucks") at very low prices thanks to NAFTA (North American Free Trade Agreement) regulations which, from 2019 onwards, will permit US trucks with no age limit restrictions to be imported into Mexico. This will, in turn, affect sales of new units that demand premium and original filters and during warranty periods.

The fierce competition that the Mexican diesel filters aftermarket faces due to the large number of participants, high fragmentation, and consumer demand and habits translates into a price war by manufacturers and distributors. To fight this situation, both manufacturers and distributors are rethinking their market strategies. Technical sales, customer relationship management programs, extended warranties by OEMs, in-site services, and third-party technician trainings are competitive strategies being adopted by manufacturers in order to face price wars. On the other hand, original equipment distributors (OEDs) prepare product "combos" with different filter brands so as to offer the best price-quality options to customers.

Finally, Mexico, together with Brazil, is the largest diesel engine filters market in the region, and owing to its proximity to the United States, holds a privileged market position not only due to its domestic market but also as a key export hub to the United States and Latin America. It is expected that the diesel filters aftermarket will show a positive growth in the coming years, but major challenges must be overcome. The illegal or "cloned" filters market can restrain many initiatives, but companies should look at this challenge as an opportunity to develop distinctive customers' approaches and product specifications at competitive prices, especially when negotiating with independent channels. On the other hand, out-of-warranty and small fleet owners customers comprise a market niche that big multinational companies must address either by educating them on the benefits of using premium filters, or developing alternative low-cost options as part of their product portfolios.

Come From: https://ww2.frost.com/frost-perspectives/diesel-engine-filters-aftermarket-mexico/